Business Insurance in and around Omaha

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Business Insurance At A Great Price!

Running a small business comes with a unique set of challenges. You shouldn't have to work through those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including business continuity plans, worker's compensation for your employees and extra liability coverage, among others.

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Insurance Designed For Small Business

Whether you own an arts and crafts store, an art gallery or a barber shop, State Farm is here to help. Aside from remarkable service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

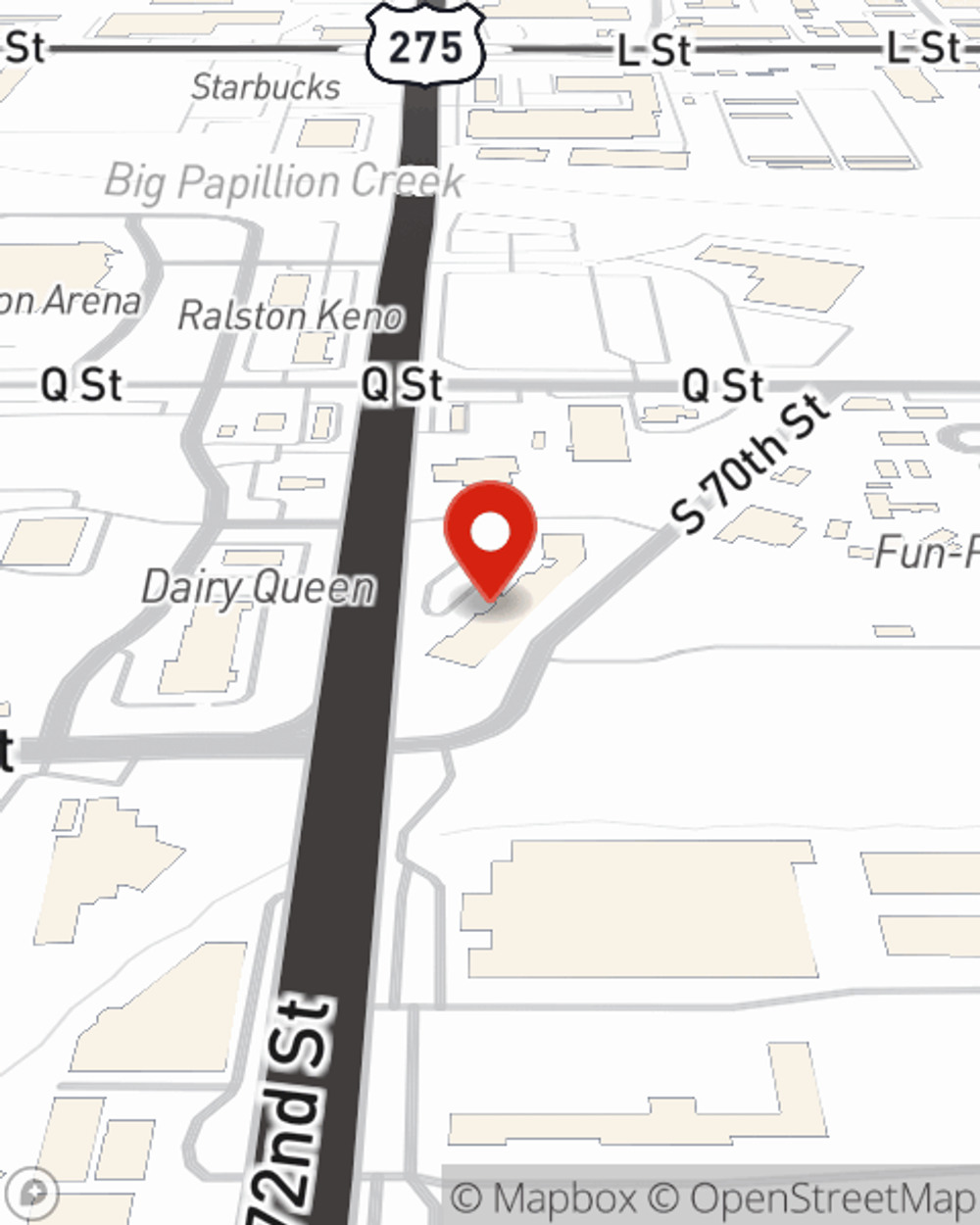

Agent Greta Ritchie is here to review your business insurance options with you. Call or email Greta Ritchie today!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Greta Ritchie

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".